Courtesy - The City Of edinburgh Council

Edinburgh Low Emission Zone

Edinburgh’s Low Emission Zone (LEZ) set to reduce vehicle emissions in the city centre, enhancing air quality & public health.

Edinburgh's 'LEZ' Came into effect on the 01st June 2024

Check to see if your vehicle is compliant.

Overview of the LEZ

The LEZ aims to reduce vehicle emissions by restricting the most polluting vehicles from entering the city center. This initiative is crucial for improving air quality and public health in Edinburgh.

Goals and Objectives

The primary goal is to lower emissions of nitrogen oxides and particulate matter, which contribute to respiratory and cardiovascular diseases. The LEZ supports the city’s broader environmental targets.

Implementation Timeline

Key Dates

The LEZ was agreed upon by the Edinburgh City Council on March 31, 2022. After a two-year grace period, enforcement will commence on June 1, 2024.

Grace Period

This period allowed residents and businesses to prepare for the new regulations. The council offered guidance and support to help vehicle owners comply with the standards.

Official Launch

The official launch marks the beginning of continuous, 24/7 enforcement using automatic number plate recognition (ANPR) technology.

Enforcement Mechanisms

ANPR Cameras

ANPR cameras will monitor vehicles entering the LEZ. These cameras can identify non-compliant vehicles based on their number plates.

Mobile Enforcement Units

Mobile units equipped with ANPR technology will patrol the LEZ, ensuring that vehicles within the zone meet the required standards.

Geographic Scope

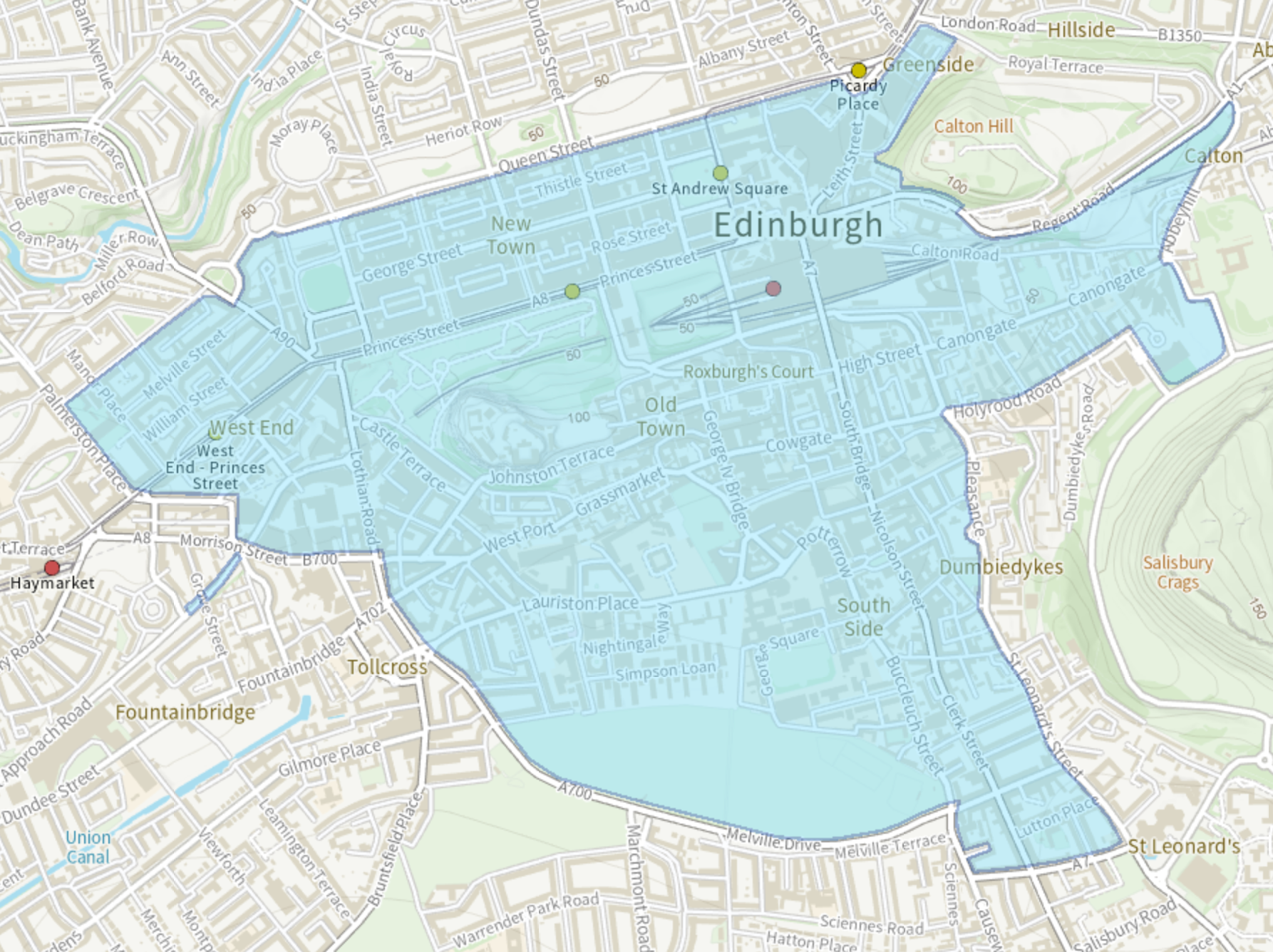

Zone Boundaries

The LEZ covers a 1.2 square mile area of Edinburgh’s city center, from Queen Street in the New Town to Melville Drive and from Palmerston Place to Abbeyhill and the Pleasance. The boundary streets themselves are not included in the zone.

Affected Areas

This central zone includes major commercial and residential areas, aiming to create a cleaner environment in the most densely populated parts of the city.

Vehicle Restrictions

Emissions Standards

The LEZ targets vehicles that do not meet specific emissions standards. Generally, most diesel vehicles registered before September 2015 and petrol vehicles registered before January 2006 will be restricted.

Vehicle Categories

The ban includes cars, vans, taxis, private hire vehicles, HGVs, buses, and coaches that fail to meet Euro 6 standards for diesel and Euro 4 standards for petrol. Motorcycles and mopeds are exempt.

Penalty System

Fine Structure

Non-compliant vehicles entering the LEZ will incur a £60 fine, reduced to £30 if paid within 30 days. Repeated offences within a 90-day period will see escalating fines, up to a maximum of £480 for cars and light commercial vehicles and £960 for heavy-duty vehicles.

Repeated Offences

The fine structure is designed to deter repeated violations, with penalties doubling for each subsequent offense within the 90-day period.

Exemptions and Special Cases

Exempt Vehicles

Certain vehicles, such as emergency vehicles, those used by disabled persons (including blue badge holders), military vehicles, historic vehicles, and showman’s vehicles, are exempt from the LEZ restrictions.

Temporary Exemptions

Temporary exemptions may be granted under specific circumstances, subject to council approval and regulatory guidelines.

Public and Environmental Impact

Health Benefits

Reducing emissions will significantly benefit public health, particularly for vulnerable populations such as children, the elderly, and those with pre-existing health conditions.

Emission Reductions

The LEZ is expected to reduce harmful vehicle emissions by up to 50% within the designated area, contributing to cleaner air and a healthier environment.

Navigating Around the LEZ

Alternative Routes

Drivers with non-compliant vehicles will need to use alternative routes that circumvent the LEZ. The council has made adjustments to certain roads to facilitate easier navigation around the zone.

Council Adjustments

Changes include making Morrison Street two-way and adding right-hand turn options at key junctions to improve traffic flow and accessibility.

Future Developments

Potential Expansions

The LEZ may expand in the future to cover more areas or introduce stricter emissions standards, aligning with long-term environmental goals.

Long-Term Goals

The ultimate aim is to create a sustainable and low-emission urban environment, enhancing the quality of life for Edinburgh’s residents and visitors.

Map of Edinburgh Low Emission Zone (LEZ).

FAQs

When does the LEZ start in Edinburgh?

The LEZ starts on June 1, 2024, following a two-year grace period.

How will the LEZ be enforced?

Enforcement will be through ANPR cameras and mobile units patrolling the zone.

What areas does the LEZ cover?

What vehicles are banned?

LEZ Vehicle Checker >Most diesel vehicles registered before September 2015 and petrol vehicles registered before January 2006 are banned.

What are the penalties for non-compliance?

What are the penalties for non-compliance?

Are there any exemptions?

Exemptions include emergency vehicles, disabled persons' vehicles, military vehicles, historic vehicles, and showman’s vehicles.

Edinburgh's LEZ is a step towards reducing air pollution and improving public health.

By restricting the most polluting vehicles, the city aims to create a cleaner and healthier environment for all.

Compliance with these regulations will be essential for drivers, and understanding the rules and exemptions will help ensure a smooth transition.

Although contentious, the new 'Low Emission Zones' zones are coming.

Many drivers are finding that an

LEVC is a good way to upgrade to a compliant vehicle.

You might also like