Which is best for a executive driver, EV or conventually powered vehilce?

Public vs. Home Charging for EVs: Considerations for Taxi Drivers?

As electric vehicle (EV) adoption rises, taxi drivers must navigate the financial and practical aspects of charging.

This article examines the benefits and challenges of public vs. home charging for EVs, focusing on cost, convenience, and downtime, with particular emphasis on the needs of taxi drivers.

Advantages

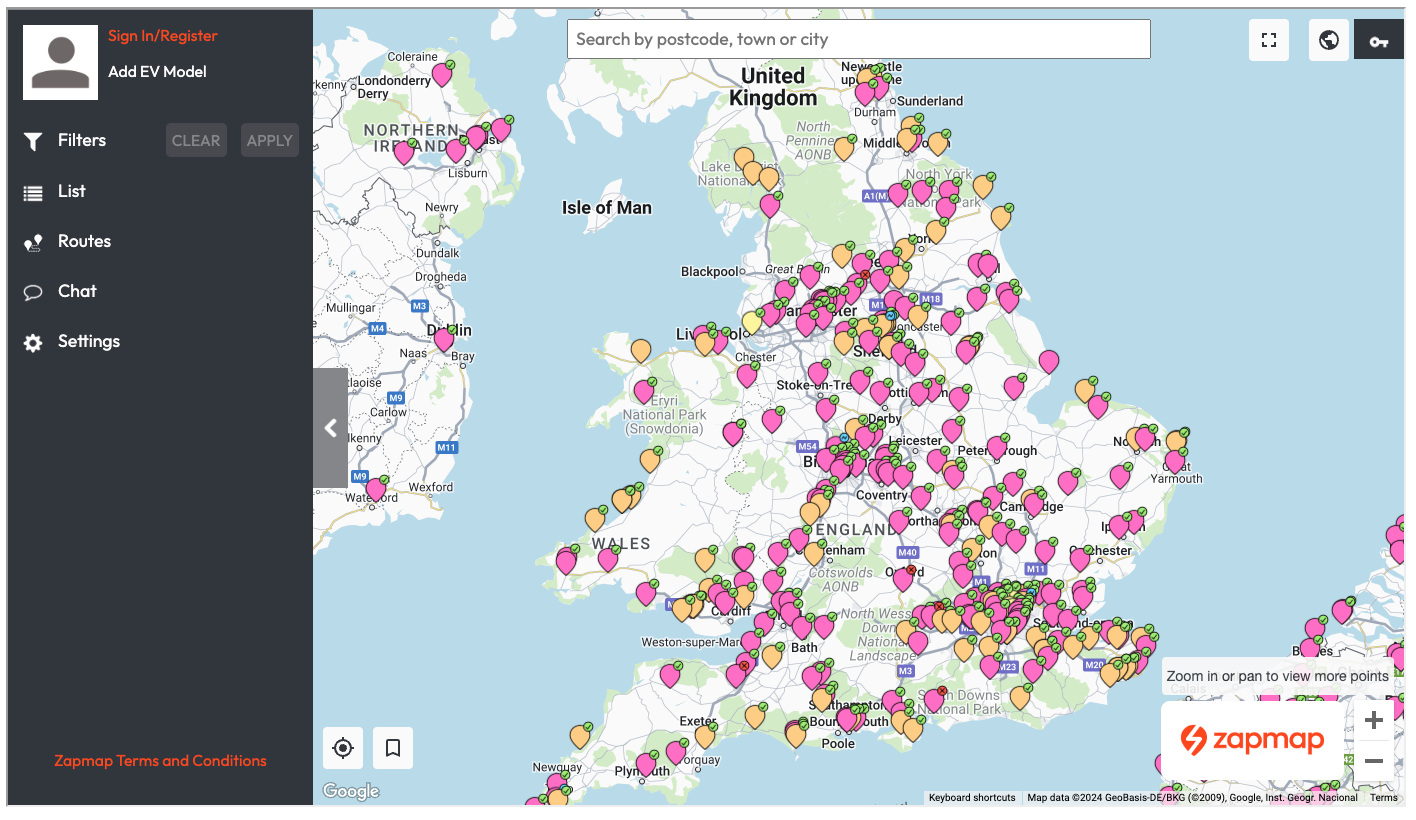

Public EV charging is crucial for taxi drivers who cover extensive distances, especially those without home charging access. Stations are located at motorway services, city centers, and other strategic points, making them accessible for quick top-ups.

Disadvantages

Public charging is more expensive, averaging around 55p per kWh for slow/fast charging, with rapid charging costing even more. For taxi drivers covering up to 50,000 miles annually, this can significantly impact operating costs compared to the lower cost of home charging.

Home EV Charging

Advantages

Home charging offers substantial cost savings and convenience, allowing overnight charging at off-peak rates as low as 10p per kWh. For a taxi driver, this can result in significant annual savings compared to petrol or public charging.

Disadvantages

Home charging requires off-street parking, which may not be available to all drivers, particularly those living in flats. The initial installation cost can be a barrier, though government grants may help offset these expenses.

Comparative Analysis

Financial Considerations

- Electric vs. Petrol Costs: Charging an EV at home is significantly cheaper than petrol. For a taxi driver covering 50,000 miles per year, home charging can save thousands annually compared to petrol, even after accounting for electricity costs.Professional Maintenance: Utilize services from accredited professionals to ensure tyres are always in optimal condition.

- Public Charging Costs: While convenient, frequent use of public charging stations can quickly add up, reducing the financial benefits of owning an EV.

Impact of Low Emission Zones (LEZs)

LEZs in city centers impose restrictions on high-emission vehicles, making EVs an attractive option for taxi drivers. Compliance with LEZ regulations can result in cost savings by avoiding fines and additional charges imposed on petrol and diesel vehicles.

Charging Logistics

- Home vs. Public Network: Drivers with home charging capabilities can enjoy lower costs and convenience, while those without off-street parking must rely on the public network.

- Charging Speed and Downtime: Charging downtime is a crucial factor for taxi drivers. Home charging typically takes longer than public rapid charging, but strategic use of charging times (e.g., overnight) can mitigate downtime. Rapid public chargers can replenish an EV in about 30 minutes, but this is still longer compared to a quick petrol refill.

Choosing between public and home charging depends on individual circumstances. For taxi drivers with off-street parking, home charging offers significant cost savings and convenience. However, public charging remains essential for those without home access and for long-distance travel.

Key Recommendations

- Compare Fuel costs: Have I calculated the yearly cost of electric vs conventionally powered vehicle?

- Does the area I work have a 'low emission zone'?The cost of daily ULEZ/LEZ charges need to be factored in.

- Down Time: Does the time it takes to recharge suit my work schedule ?

- Do I have a driveway?: Access to overnight home charging gives access to cheap overnight rates

FAQs

Is home charging cheaper than public charging?

Yes, home charging, especially using off-peak rates, is significantly cheaper than public charging.

How does driving 50,000 miles a year affect charging costs?

For high-mileage drivers like taxi operators, home charging can save thousands annually compared to petrol or frequent public charging.

What is the impact of low emission zones on taxi drivers?

LEZs favor EVs, helping taxi drivers avoid fines and additional charges associated with high-emission vehicles.

How can taxi drivers manage charging downtime?

Taxi drivers can minimize downtime by charging overnight at home or using rapid public chargers strategically during breaks.

Are there grants for home charger installation?

Yes, various government grants are available to help offset installation costs.

Where can I find public charging stations?

You might also like