Robotaxis, regulation and the ripple effects across the UK taxi market

2026 looks like a hinge year for taxis. Robotaxis — once largely experimental — are moving into pilot deployments and commercial proofs, and that has immediate implications for operators, regulators and drivers across the UK. At the same time, changes to tax treatment for ride‑hailing are reshaping platform economics and driver obligations. Together, these trends mean the taxi sector is entering a period of rapid structural change.

From showrooms to streets

Global firms unveiled production‑capable autonomous vehicles at CES, and reported on‑road testing in the U.S.; ride‑hailing platforms have also announced partnerships to trial Chinese‑made autonomous vehicles on UK roads in 2026. These pilots rely on recent UK legislation that clarifies liability and creates a framework for trials, making Britain an attractive place for operator experiments. For fleet owners and councils, the immediate priority is to understand how trials will interact with taxi ranks, licensing zones and existing public transport.

Safety, congestion and city design

The hype is colliding with sober analysis. Several commentators argue Europe’s dense, bike‑friendly cities present unique challenges for autonomous fleets: tight streets, mixed users and high pedestrian volumes make safe, efficient deployment harder than in wide‑street U.S. cities. Observers warn that without strict operational limits and transparent reporting, robotaxis risk adding “deadheading” miles (empty trips between fares) that increase congestion. Regulators will closely watch trials’ safety datasets, incident logs and zone restrictions before any broader rollout.

Economic impacts: drivers, fares and taxation

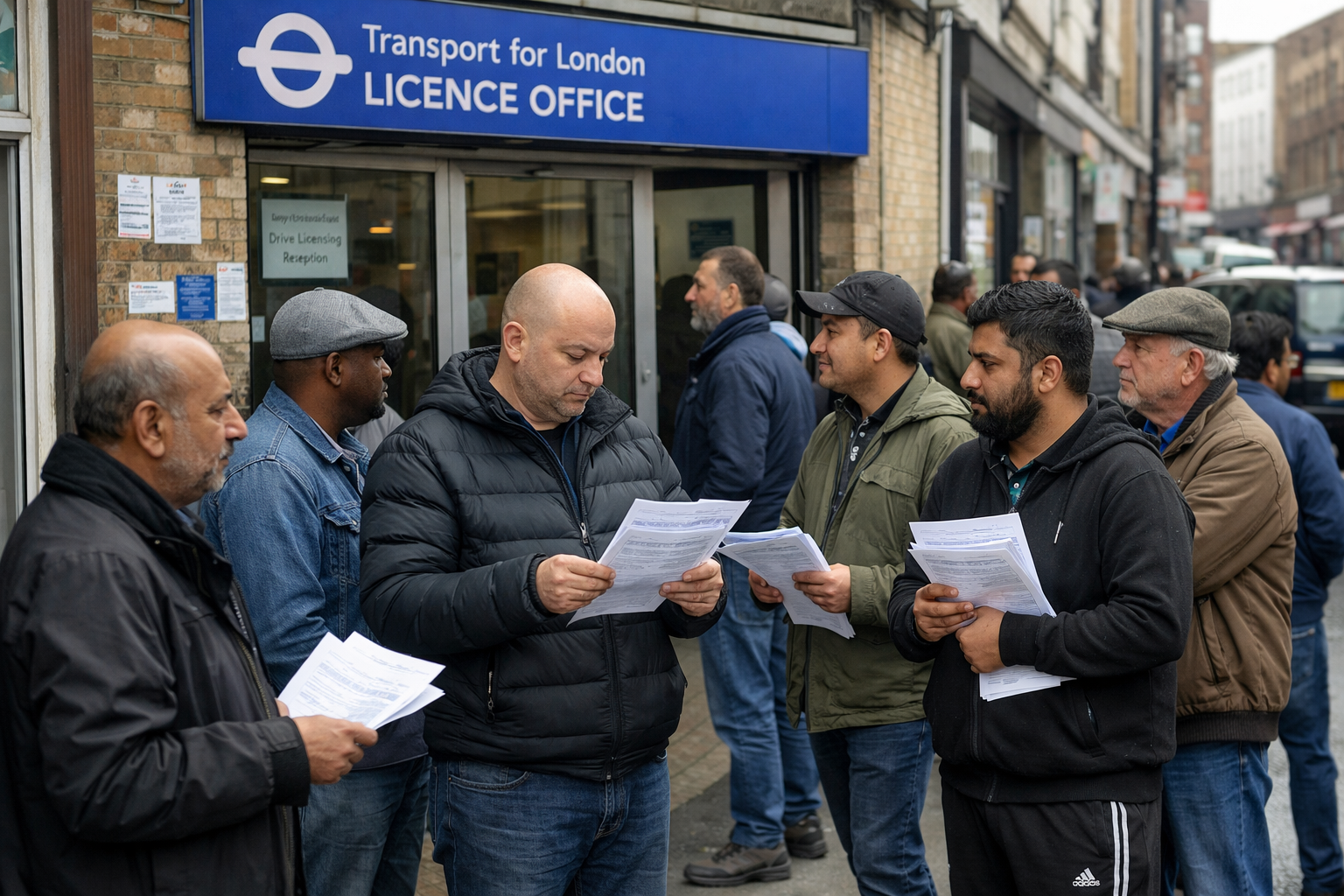

Parallel to technological change, fiscal and legal adjustments are reshaping the competitive landscape. A recent UK tax policy aimed at bringing ride‑hailing fully into standard VAT treatment has prompted platforms to restructure driver agreements outside London, passing VAT treatment onto drivers where legal frameworks allow. This dynamic affects driver take‑home pay, platform pricing and the broader comparability between traditional taxi services and app-based alternatives. London’s tighter regulatory stance means the effect will be uneven across the country, complicating fleet planning for operators working in multiple jurisdictions.

What operators, councils and policymakers should watch

Data transparency: insist that pilot operators publish anonymised safety and operations data. Independent review builds public trust. Reuters

Urban management: coordinate geofenced trial zones, curb access and rank allocation so trials do not displace buses, bikes or active travel lanes. Financial Times

Fair taxation & labour impact: monitor contractual changes and tax pass‑throughs to avoid unintended reductions in driver incomes or unfair competitive gaps.

Bottom line

The UK stands at a crossroads: it can be a world leader in proving how robotaxis can integrate safely and usefully into city transport — or risk fragmented pilots that increase congestion and undermine public trust. Combining transparent trials, targeted local regulation and attention to driver economics will determine whether the technology delivers public benefit, rather than just headlines.

You might also like